The Internal Revenue Service says it is working on the Simple Notice Initiative, a sweeping effort to simplify and clarify about 170 million letters sent annually to taxpayers.

Part of the larger transformation work taking place at the IRS with Inflation Reduction Act funding, the Simple Notice Initiative will build off redesigned notice efforts in place for the 2024 tax season and expand on a recent successful pilot involving identity theft letters.

The Simple Notice Initiative will review and redesign hundreds of notices with an immediate focus on the most common notices that individual taxpayers receive. The redesign work will accelerate during the 2025 and 2026 filing seasons, improving common IRS letters going out to individual taxpayers and then expanding into notices going to businesses.

The IRS sends about 170 million notices to individual taxpayers every year, covering a range of issues from claiming the credits and deductions for which they are eligible for as well as meet their tax obligations. These notices are often long and difficult for taxpayers to understand. And they do not always clearly and concisely communicate the next steps a taxpayer must take.

“Simplifying and clarifying these letters will make it easier for taxpayers to understand the tax issues involved,” said IRS Commissioner Danny Werfel. “This will help reduce questions and save headaches for taxpayers, the tax professional community as well as the IRS. Improving these letters is also critical to our internal operations at the IRS, and an important part of our transformation efforts. Clearer letters can create a ripple effect, reducing taxpayer phone calls and visits and freeing up IRS staff to help others.”

This initiative builds on the IRS Paperless Processing initiative announced in August 2023 to advance the goal of providing world-class customer service to taxpayers. With these initiatives, taxpayers have the option to go paperless and conveniently submit necessary responses online, and taxpayers will receive clearer and more concise notices from the IRS, so they better understand the actions they need to take.

Filing season 2024: IRS reviewed, redesigned 31 notices

- The Simple Notice Initiative builds on the IRS’s continuous effort to improve notices. During the last year, the IRS reviewed and redesigned 31 notices in time for this year’s tax season. The IRS sent about 20 million of these notices in calendar year 2022.

- These include notices to taxpayers who served in combat zones that may be eligible for tax deferment, notices that remind a taxpayer that they may have unfiled returns and notices that remind a taxpayer about their balance due and where they can go for assistance.

Filing season 2025: IRS will review, redesign most common notices sent to individual taxpayers

- By filing season 2025, the IRS will review and redesign the most common notices that individual taxpayers receive. The IRS will focus on up to 200 notices that make up about 90% of total notice volume sent to individual taxpayers. This represents about 150 million notices sent to individual taxpayers in 2022.

- These include notices to propose adjustments to a taxpayer’s income, payments, credits, and/or deductions, notices to correct mistakes on a taxpayer’s tax return and notices to remind a taxpayer of taxes owed.

- The IRS will be actively engaging with taxpayers and the tax professional community to gather feedback on how these notices should be redesigned.

Filing season 2026 and beyond: IRS will review, redesign notices sent to businesses taxpayers as well as less common notices sent to individual taxpayers

- The IRS sends over 40 million notices to business taxpayers every year. In future filing seasons, the IRS will review and redesign notices sent to business taxpayers.

- The IRS will also review and redesign less common notices sent to individual taxpayers.

- Additional detail on the plan to redesign these notices will be shared in future updates.

Recent notice pilot shows how a redesigned notice can improve taxpayer experience while reducing call volume

The IRS is committed to delivering a better taxpayer experience through notices, over the phone, online and in-person. While taxpayers will always have the option to call, the IRS also wants to make it easier for taxpayers to resolve issues without having to pick up the phone. Plain language notices can help the IRS achieve this goal.

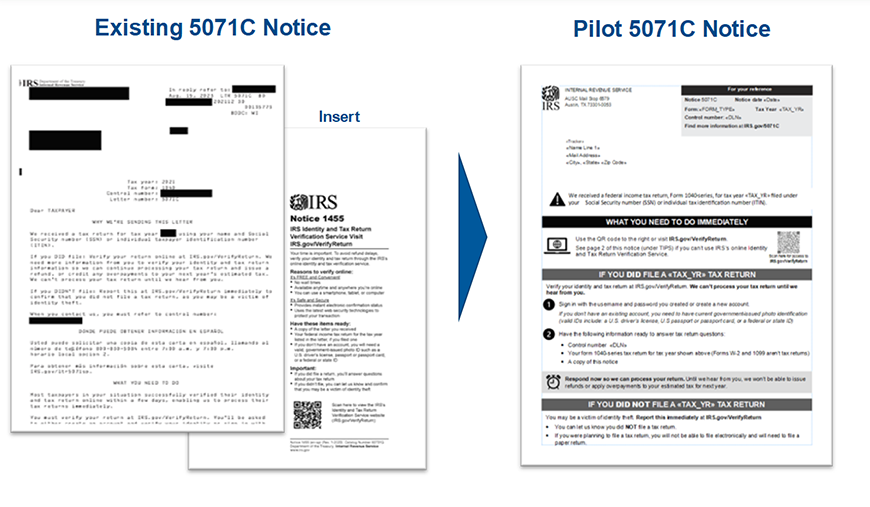

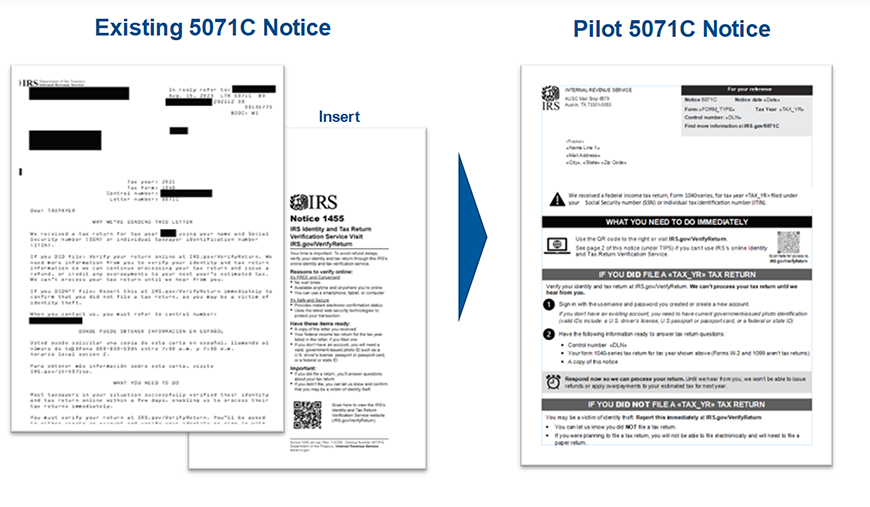

For example, the IRS recently conducted a pilot that sent redesigned versions of Notice 5071C to a subset of taxpayers. The Notice 5071C asks taxpayers to verify their identity and tax return online or over the phone to prevent the processing of fraudulent tax returns. As part of the redesign, the IRS shortened the 5071C notice from seven pages to two pages. The IRS also improved readability of the notice by updating the font and adding visual enhancements such as headers, icons and step-by-step instructions.

The IRS also clarified instructions and added a QR code that directs taxpayers to the IRS webpage where they can respond to the notice online instead of responding over the phone. See below for an overview of improvements that were made.

The IRS sent the redesigned Notice 5071C to 60,000 taxpayers. Compared to taxpayers who received the original notice, there was a 16% reduction in taxpayers who called the IRS as their first action, and a 6% increase in taxpayers who used the online option. The IRS will apply lessons learned from this pilot, among others, to the new initiative. These changes to this notice will be put in place during coming months.

Notice 5071C: Before and after redesign shows changes

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs